In the first part of this article, we have said that success is not a result of sudden events or “accidents” but the accumulation of small and seemingly unimportant actions performed over a period of time. These small positive actions when applied to our financial situation can reap great benefits in the future as evidenced by the compounding effect.

However, compounding also has a dark side to it, which can result in great losses instead of great benefits if it is allowed to accumulate over time.

The curse of compounding

If you consider the power of compound interest as one of man’s greatest inventions, then you also need to be aware that it is also one of man’s greatest curses. This is probably one of the main reasons why people do not have their finances in order or find it very hard to get ahead.

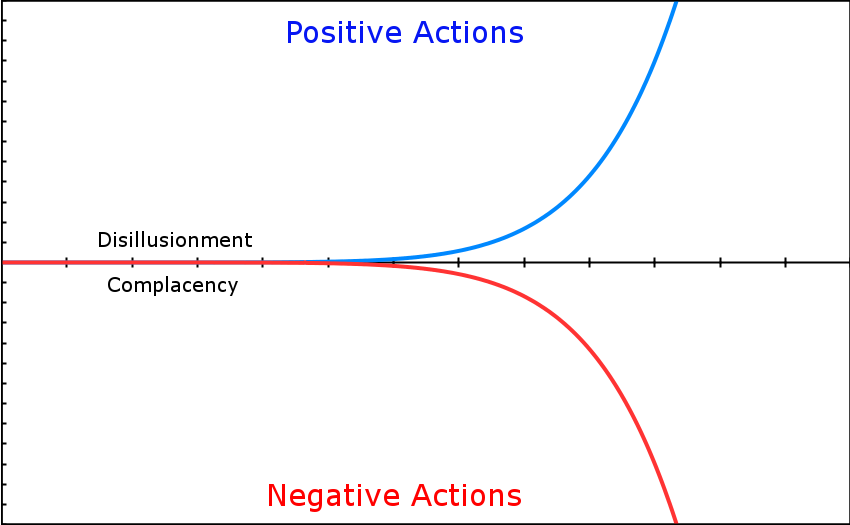

If you look at the compounding graph, it is actually composed of two sides:

The top line (in blue) shows the compounding graph when the interest is positive, while the bottom line (in red) shows the graph when the interest is negative. This is the main illustration of the consistency beats intensity philosophy and we will describe how this applies to your finances.

The blue graph is the result of consistent, positive actions, like regularly investing and saving. Even if you are investing small amounts, if done regularly and given enough time, it will result in positive growth that accelerates as time goes on as shown on the rightmost part of the graph.

The red graph is the result of negative actions that reduce the amount of money that we have. A good example of this is credit card debt that is not paid in full every month. A normal interest rate if you do not pay your credit cards on time is 3.5%, meaning there is a -3.5% interest rate that adds to your credit card balance. As you continue to delay paying your credit cards in full, this 3.5% compounds over time and results in a larger and larger amount that you need to pay. Eventually some people only have enough money to pay for the interest of their credit cards and the actual debt is not being paid, creating a vicious cycle that is very difficult to get out of as negative compounding takes effect.

Another example of a negative action is by not investing at all. Under normal circumstances all countries experience inflation, meaning that the value of your money decreases over time. If you remember a time in your childhood when buying a chocolate bar only costs ₱5 but now it costs ₱20, this is the effect of inflation. If you kept your ₱5 in a piggy bank when you were a child, you will no longer be able to buy a chocolate bar using that same money today.

The same effect happens when you leave a lot of money in your drawer or in your bank and do not invest it. The Philippine’s inflation rate as of January 2017 is 2.7%, meaning that unless your money earns 2.7% every year or more, it is actually losing its value. Interest in savings accounts usually earn only around 0.25% annually, which is a far cry from the rate of inflation.

To combat this you need to invest your money in order to earn high enough interest. Whether you invest it in stocks or bonds, in real estate, or in your own business, it does not matter as long as you are earning positive returns for your money that beats inflation. By doing this you are essentially preserving the value of your money while also enabling it to increase its value.

Easy to do, easy not to do

We have now established that you need to save and invest regularly, even if its only for small amounts at a time. When we look at the compounding formula and graph, it shows that time is necessary to achieve the desired outcome. And since we are investing only small amounts, it may feel like it is not making any difference at all and we lose the motivation to continue. I call this the Disillusionment/Complacency period.

The Trap of Disillusionment

In the early parts of the compounding graph, you will notice that it does not appear to move beyond the starting point, and that both positive and negative actions appear to go through the same line and seem to have the same effect. When you do positive actions, it may feel like these do not have any effect in your life at all. If you start saving let’s say ₱1000 per month, it does not look like it has any impact in your finances and you certainly do not feel “richer”.

If you start to feel like this in your investment journey, acknowledge that this is a part of the process and you should not lose motivation on your end goal.

Do not despise these small beginnings, for the Lord rejoices to see the work begin, to see the plumb line in Zerubbabel’s hand. – Zechariah 4:10 (NLT)

Beginner investors tend to be excited about their investments and so they check their accounts daily or even multiple times a day. More often than not, this exercise robs people of motivation as they do not see significant increases in their money, and even experience paper loss if it is invested in equities. A more reasonable approach is to instead just check your accounts in longer spans of time, perhaps monthly or even quarterly.

In the meantime, while you are waiting for the compounding effect to kick in you can focus your time and energy into furthering your career or building your main or side business. This has a better return on investment on your time instead of worrying about your investments on a daily basis.

In a similar vein, when we do negative actions regularly:

The Dangers of Complacency

When something feels insignificant, we tend to ignore them and do not think about the consequences. When we try to justify our luxurious expenses as

- Just this one time

- I deserve this

- I will still have a paycheck next month

We fail to see its impact in the future as it appears to have no immediate effect in the present. Another example of this is by skipping our saving/investing for the month with thoughts like:

- ₱500 (or any other amount) does not really feel like much anyway and won’t affect my finances

- I will just save more in the next month

- I feel really stressed this month and I need something to get my mind off of it

- Retirement is a really long time from now and I should be enjoying life to the fullest

These thoughts can be reinforced by society itself as you see your friends and co-workers do the same things with their money. This is comforting to us as we are social beings and doing things that other people do feels easy and right. However, by doing these seemingly little, unimportant things, we move more towards the curve of negative actions until there comes a time when we wake up and wonder why we are having trouble financially.

Both disillusionment and complacency is a trap and we need to guard ourselves against those feelings as we continue in our financial journey.

Automate only the good things

An effective way to make us ride the compounding graph easier is to use automation. Automation basically removes our emotions from our actions as these actions require no thought or effort on our end. As with the previous section, this is also a double-edged sword.

Automating the bad things will make you go to the negative curve much faster, and makes it more dangerous as you are not seeing where you are headed. An example of this is by putting your subscriptions on automatic debit arrangements or through recurring payments via credit cards. Things like your cable TV that you don’t watch that much, magazine subscriptions that you do not read and just accumulate in your living room, or club memberships that you use only once a year. In these cases its better to remove them from auto-debit or recurring payment so you will have visibility of the money coming out each month.

It is also good to consider if you can rent or lease those services and products you are subscribing to. Instead of subscribing to a magazine, why not just purchase a library membership and enjoy all of the magazines and other reading materials as you please? Instead of the club membership, it may be less expensive to just lease or rent the place as you need them instead of constantly paying the fees.

On the other hand, automating the good things will make you ride the positive graph faster as these positive actions require no effort or thought on your end. Some examples where this can be applied are:

- Set up an automatic transfer to your savings account for every paycheck that arrives. This makes it easier to pay yourself first, and learn to live on what is left of your pay after you have saved a portion

- Ask your bank if they have automatic debit arrangements on your account that can be invested in equities or other vehicles. Examples of these are BDO Easy Investment Plan or BPI Save-Up, where you can specify the amount that they will debit from your account on a schedule that you want and they will invest it in an equity fund automatically. You will be surprised at the amount that is accumulated after a few years even using modest monthly amounts.

Hopefully this gives you a better idea on the effect of compounding (both good and bad) on your finances. Each individual has its own unique set of circumstances, opportunities, and obstacles, so you will need to determine which actions make sense for you in order to move towards making positive actions and move away from making negative actions.

One thought on “Consistency Beats Intensity: Finance, Part II”