When was the last time you have looked at your expenses this month? How much are you saving per year? Do you pay all your bills and debts on time? Do you have investments years ago that you have forgotten about? The new year can be a good time to reflect on how you are doing with your finances and to see if it has turned cold in some way. If it has, then maybe it is time to reignite your passion about handling your finances well. This is my story on how I regained my passion on personal finance after almost a decade.

After I graduated from university in 2005 I immediately found a job at a software company for printer hardware. I chose this job because it paid well relative to the other job opportunities I had. When I received my first paycheck, it felt very weird as it was my first time handling a “huge” amount of money. As with most people during college, I constantly lack money and sometimes had to borrow from friends to get by, so a month’s paycheck looked a lot of money for me then. Not knowing better I then proceeded to find a way to lose all that money again by spending and giving it away, probably because I was not used to having money before. This continued on for months.

After more than a year of work and a little bit of introspection I figured that I will not go anywhere if I continue this path. I want to have a family someday and support them financially, I thought. So I started saving my money and opened up a savings account at the bank nearest to my workplace.

As an engineer by education I also tend to optimize things in my life, and one of the results of that was I started to track down all of my daily expenses, down to the last peso. Since I started working I have been diligently recording all those income/expenses in a spreadsheet, which I update daily or when time permits.

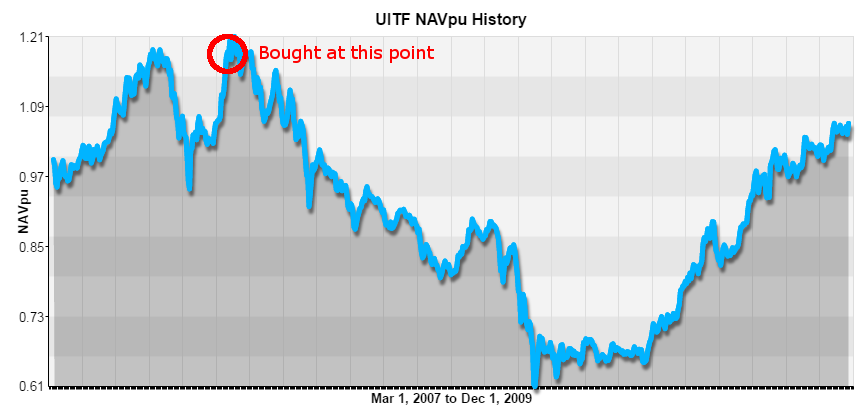

In 2007 I was hearing conversations in my office about stocks and how they are making lots of money by buying and selling them. I was curious, but afraid to try it out myself as I don’t know what I am doing. I asked around and they suggested that I buy a mutual fund instead where I let an investment manager handle all the hard work while I just give them money and watch it grow. I went to my bank (just outside the office) and invested in my very first Equity Fund. I said to myself that I will set aside money each month and make my investment grow even more. After only 2 months of purchasing more of the Equity Fund, the recession suddenly had its effect on the Philippine market.

I watched my money grow less and less in value. Because of this I stopped adding into the fund monthly as I was afraid it will go down further and I will lose more money. My co-workers suggested that I pull-out while its early and that they have already sold their investments as the recession is destroying the market. As I was too lazy at the time (or maybe I don’t really care that much), I just left my money in the fund and sold nothing.

I left my job in 2008 for personal reasons and found another job at a software company 5 months later. I accepted a smaller salary compared to my previous job as I thought this is a good working experience for me. My savings at that time are also at an all-time low as I was out of work for 5 months. Now in my mid-20s, I totally ignored my finances and proceeded to enjoy life instead, going out regularly with friends and doing some financially-destructive habits in the process.

In 2010 I met my girlfriend (and future wife) and it changed my focus back to my personal goal of having financial stability. I left my job in 2011 and in the process eventually found an application developer position for a foreign company. This resulted in a significant increase in my salary, and also my first foray into working remotely (or working from home).

Working from home has been beneficial for finances as you reduce costs associated with your work. Buying work clothes, transportation costs, and eating out with co-workers no longer occupy my budget. At the same time this also opened up additional few hours of free time each day that I had previously spent going to and coming back from work. However at the time I still had no interest in investing and just continued putting my extra money in my savings account, mainly to replenish my depleted savings and also to prepare for our wedding.

We got married in 2013 (all paid in cash), and also bought a used car (as I was new to driving) in the same month as a result of years of saving and having a modest lifestyle. During that time the market has bounced back and is growing strong and I am starting to hear friends talk about the stock market again. Still I had no interest at the time and just continued saving.

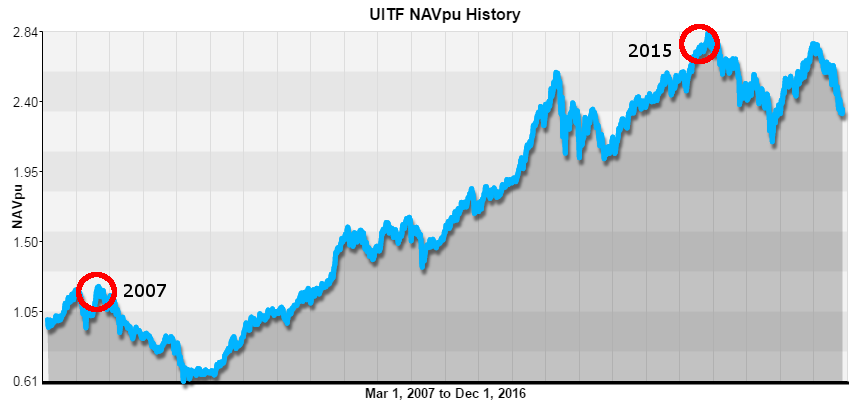

In 2015 at a company meeting I had a co-worker ask me if I am investing in the stock market. I said no but told him that I invested in an equity fund many years ago and had forgotten about it. That conversation piqued my interest and I checked the current value of my equity fund investment. To my delight I found that the value of my money almost tripled in value! So even though I bought at the “top” of the market back then, I was still able to get good returns (although it was at the span of almost a decade).

Then a thought occurred to me: I had bought in at probably the worst moment at the time, but still I was able to get significant returns after a few years. What would have happened if I continued investing during the down years? I can only imagine that the current value of my investments would have been many times more than what I had now. I also learned about the power of not caring, that is, if I had succumbed into peer pressure and the gloomy news back then, I would have sold at a loss and missed the opportunity to grow my money.

I wondered why I stopped learning about these things many years ago and how many missed opportunities I had during those years. In retrospect, all those past years are the reason why I am like this right now, and so I do not really regret the decisions (including the very stupid ones) I had made as those experiences led me to where I am today. I decided to take a look at investing again and found renewed interest in it, in hopes of achieving my own financial independence.

I started by searching the internet for “financial independence”, which led me to a subreddit called FI/RE (https://www.reddit.com/r/financialindependence/). Their description says:

This is a place for people who are or want to become Financially Independent (FI), which means not having to work for money.

Not having to work for money! What a glorious concept. I immediately consumed all of the top posts on the subreddit, and continued on reading every night before I go to sleep. Their topics mainly focus on US-only features like 401ks, Roth IRAs, Conversion ladders, 503Bs, but I was hooked! The basic premise is simple and can be applied wherever you live: to live below your means and invest your savings wisely.

This subreddit led me to the Mr. Money Mustache (MMM) blog, http://www.mrmoneymustache.com/. The blog opened up a whole lot of ideas on how to minimize your expenses while still living a rich and comfortable life, basically it helped me adjust my mindset on the real costs of living and how some of our “expenses” are not really contributing to our happiness. The subreddit also led me to another blog by Jim Collins, http://jlcollinsnh.com/, where the Stock Series section opened my eyes on the proper attitude when investing in the stock market.

In addition to these blogs, I also started reading books about personal finance and investing, notably Common Sense on Mutual Funds, A Random Walk Down Wall Street, The Richest Man in Babylon, Total Money Makeover, and Your Money or Your Life. However I found it a bit difficult to devote time daily to read books due to work and family responsibilities, so I eventually started listening to podcasts like Radical Personal Finance, Side Hustle Show, Money for the Rest of Us, MadFIentist, and the You Need a Budget Podcast. This allowed me to absorb information while doing menial work, as I described in this blog post. I found listening to podcasts so practical and useful to me that I am now shifting to listening to audio books instead of reading the books themselves.

With all these new insights and information it made me more passionate about investing, and so in addition to my existing Equity Fund investment years ago (which I still haven’t sold), I opened up and started the following:

- An Equity Index fund for low-cost passive investment

- An automatic debit arrangement for another Equity Fund as my “no-brainer” investment, forcing me to cost average and to put in regular amounts

- An online brokerage account so I can scratch the itch of “playing” with the stock market, and to practice value investing

- Portion of savings allocated to other types of investments outside of paper assets (stocks and bonds)

- A term insurance for low-cost life insurance (although term insurance in the Philippines is still very expensive compared to the US)

- A low-cost VUL insurance as a long-term alternative to the term insurance (as described in this post)

I am no investment guru and I am far from being financially independent, but I have learned a lot by consuming all of those resources above. With all the things I learned I wanted to share them with other people and so one of my mid-term goals is to become a Registered Financial Planner so I can formally help people get to terms with their finances. I am also starting this blog so I can share some of the things I have learned and experienced in the hopes that others can relate to them and apply them in their own lives.

I expect that I will (and still) make investing mistakes in the future, but I will consider them as my “tuition fee” for the education that I gain for every failed investment. While I sometimes feel that progress is slow, looking back at the past years I start to see real growth as I control my expenses and save as much as I can. Since I was keeping track of my daily expenses for 11 years now, it provides the needed data for me to see how my income has gone up through the years and also how my expenses changed based on my situation.

My investments may not be that much today, but as I continue building on it and letting the power of compound interest do the work, I am hopeful that the fruits of my labor will bear fruit in due season so I can help myself, my family, and others as well.