In 2008, the Personal Equity and Retirement Account (PERA) Law was signed in the Philippines. Eight years later, there was still no progress on the actual implementation until September of 2016 when BDO was accredited as the first PERA Administrator.

Retirement Accounts

Retirement accounts are usually set up by a government in order to encourage its citizens to save money in the long term. One major benefit for the government to do this is that it tones down government-sponsored pension expenses and so effectively reduces the amount of money needed to support their retired population. One drawback for this is that citizens are now being asked to manage their own retirements instead of relying on the government or the businesses that they are employed in to handle those investments. It is therefore important for everyone to educate themselves on the advantages and benefits in properly managing their retirement accounts.

Individual Retirement Accounts (IRA) are being enjoyed by US citizens for many decades now. They have two “flavors” of the IRA:

- Traditional IRA – contributions are made to the account tax-free and the growth of the account is also tax-free. However, for distributions made upon retirement the appropriate tax levels are applied.

- Roth IRA – contributions are made to the account after applying the appropriate taxes, but the growth of the account is tax-free. Upon retirement age, the distributions are received tax-free as well.

The Philippines has a better version of this (the PERA), as contributions, growth, and distributions are all tax-free!

Basic Setup

There are two major roles in a PERA Account:

- Contributor – the person who is contributing to the PERA account and the one who owns the assets inside it. In short, this is you!

- Administrator – the organization that manages your PERA account and makes sure that all of the necessary documents are sent to the government relating to your account. This is the Bank or any other accredited organization that you open a PERA account to.

PERA Features and Benefits

Since this is a Retirement Account, the main idea is that your money is set for the long-term and is intended for use in your retirement. Under the PERA Law, you can only start withdrawing your money at age 55 (or under any exemptions described below). Trying to withdraw your money before age 55 will incur penalties, therefore you should only contribute money to your PERA account that you do not intend to use within the next years or decades.

This disadvantage of having your money “locked-up” has a very attractive upside of tax and estate advantages and higher investment potential.

Tax Advantages

Normally, when you invest in a Mutual Fund or a UITF, or even in individual stocks, all of these types of investments incur capital gains tax and income tax, which reduces the amount of money you are able to get from the investment. For investments inside a PERA account, it can grow tax-free. When you withdraw your money upon reaching retirement, it also does not incur income tax and so you will get the best bang for your buck.

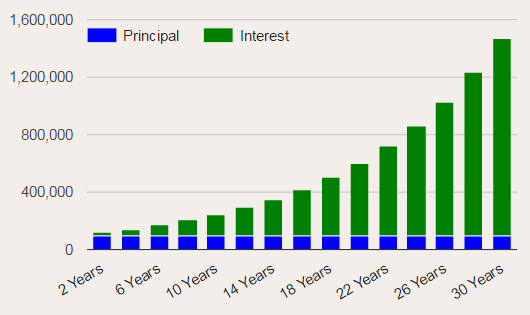

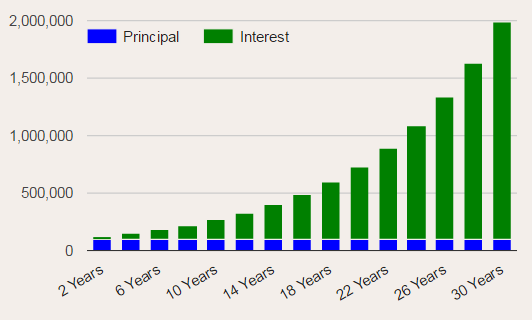

To illustrate the effect of tax-free investments, consider the following charts below:

Both charts shows the value of an investment assuming an initial amount of ₱100,000, with no subsequent contributions, with a 10% return per year. The top chart shows the effect of a 1% annual tax deduction from the investment, resulting in a 9% effective rate of return per year. This results in a total value of around ₱1.5 million at the end of 30 years.

The bottom chart shows the growth if there are no taxes or other expenses on the investment. This results in a total value of around ₱2 million at the end of 30 years. Note that this chart assumes no additional contributions per year, which will further amplify the effect of the taxes in the growth of the investment.

Your contributions inside a PERA account will also give you a 5% tax credit, so if you have contributed ₱100,000 for the year, you can deduct ₱5,000 in the income tax that you pay for that year. Note that this tax credit is non-refundable and non-convertible to cash and so the excess tax that you paid will not be given back to you.

Asset Protection

When you die, your assets are not automatically transferred to your beneficiaries (like your spouse or children). The government will first require that you pay the appropriate estate tax before these assets can be received by your beneficiaries. This means that upon death, your savings accounts, investment accounts, and properties are all subject to estate taxes.

Insurance companies have banked on this idea as one of their their selling points since insurance proceeds are exempt from estate taxes. The PERA account offers another avenue for people to protect their assets because your PERA account is also exempt from estate taxes upon your death.

Another important aspect of the PERA account is that it is also protected against lawsuits or indebtedness.

From the BSP Guidelines:

PERA assets shall not be considered assets of the Contributor for purposes of insolvency and estate taxes.

Another explanation from the PSE:

PERA cannot be used to secure indebtedness, therefore, creditors cannot run after PERA assets, and courts cannot attach, garnish or seize those to enforce a court judgment.

Amount of Contributions

There is a ₱100,000 annual contribution limit to a PERA account that you can invest, or ₱200,000 annual contribution limit for Overseas Filipino Workers (OFWs). You may add more contributions above the limit, but they no longer apply to the tax credit (and Administrators may opt not to accept it).

You can also open up to 5 PERA accounts, provided that they are all under the same Administrator or bank. While using only a single account is fine, utilizing more accounts will enable you to diversify your investments to reduce risk or maximize returns. Note that there is only a single investment vehicle that you can use on a single PERA account, so using 2 or more accounts will enable you to invest in an Equities/stocks fund, and another in a Bond fund. This strategy will generally reduce the volatility of your overall investment performance.

While you may opt to withdraw your PERA account starting at age 55, you may still continue contributing beyond age 55. This will allow your investments to grow more and increase your distributions upon retirement. It may be a good idea to start withdrawing your accounts starting at age 60 instead, so it coincides with the pensions that are given through social security programs (SSS or GSIS).

Withdrawals

After age 55, distributions can be made on a lump sum or through regular pension, as long as you have contributed for at least 5 years. In my opinion, choosing which distribution method to use will depend on your overall health condition and needs. If you have a serious illness which may involve large medical costs, it can be a good idea to withdraw your account on a lump sum so you can use the money for medical purposes. If you are healthy, it is better to get the regular pension instead so you can enjoy the benefits of your account longer.

After retirement, the remaining balance in your PERA account will be given to your beneficiaries at the time of your death. As described in the advantages above, this money will be free from estate taxes.

Penalties

There will be penalties if you withdraw your account prior to age 55. The penalties are waived if you are rendered totally disabled or hospitalized for more than 30 days.

Summary

The PERA account is a very useful tool in your personal finance arsenal, and I encourage everyone to participate in it. In addition, you must also be aware of the advantages and disadvantages in using this type of account.

Pros:

- Your investments grow tax-free

- You can withdraw your money tax-free (given the rules)

- Your assets inside the accounts are exempt from estate taxes

- Encourages long-term investing and saving

- Distributions will complement social security pensions and will improve your living situation upon retirement

Cons:

- Your money is “locked-up” in the PERA account so you cannot use it for short-term needs

- Your options are limited only to accredited types of investments

For more information, you can refer the the official central bank guidelines here http://www.bsp.gov.ph/regulations/laws_pera.asp

I have been reading out a few of your posts and i must say clever stuff. I will make sure to bookmark your blog.