When we think of investments, we usually think of stocks, bonds, or real estate. Personal finance media often focus on these popular asset types. They teach us to maximize our retirement funds, invest in low-cost index funds, diversify with bond funds, and buy rental houses.

While these are all good advice and it certainly helped a lot of people improve their financial standing, I think it overlooks a very important asset. One that can yield great returns when utilized properly, can improve your lifestyle, and more importantly, one that you already own!

An asset you already have

It would be an understatement to say that our careers shape our lives. Until recently, the location of our work mostly dictates where we live. The workplace is also where people meet others, develop friendships, and even find their mates. Your role and position in your job has a profound influence in your social circle outside of work.

This is why it is counterintuitive that we focus more on external investments and assets while ignoring (or even sometimes neglecting) our own careers. The focus should be on things that we can directly control before we deal with those we can’t.

The mainstream wisdom on how to achieve financial freedom is by doing these things:

- Save a minimum percentage of your salary

- Maximize your retirement accounts

- Invest in low-cost index funds

- Pay off consumer debt immediately

This advise makes a lot of sense, and is actually correct. The problem with this is that it fails to take into account the scale of the money involved.

The importance of scale

Consider the situation of Lauren, a young woman who has been working in the same company for 5 years. Growing up from a modest background, she wanted to have a good financial future. So she studied the concepts of personal finance and applied them to her life.

She saves at least 20% of her salary each month, puts a portion of her savings into retirement accounts and another portion into a low-cost index fund. In addition, she is diligent in paying her credit cards in full each month, and has no debt apart from the mortgage for a small condominium unit that she lives in.

Sounds like a great plan to have a secure financial future, isn’t it? The reality though is quite different. 30 years from now, she won’t be able to retire without sacrificing aspects of her current lifestyle.

And the reason? The raw amounts involved are just too small. In her job, she only earns around P25,000 per month. This means that she is saving P5,000 per month, of which P2,000 is allotted to her retirement fund.

Compounding

Compounding is our greatest tool when it comes to investing. Its effects can be achieved through the following:

- consistent amounts being invested regularly

- allowing your investments to grow for a long time

The problem with having a lower scale in terms of investing is that, even if you are saving consistently and allowing your money to grow for many years, the effects of compounding will be stunted. Consider the following examples:

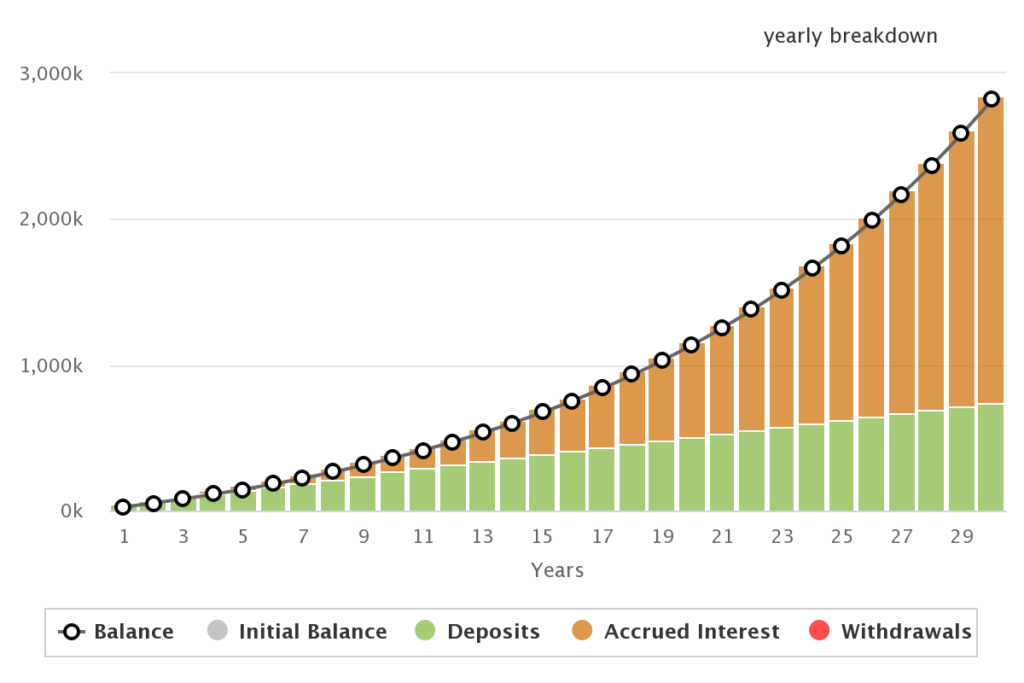

At present, Lauren invests P2,000 per month. Assuming that she has 30 years before she retires, and that her investments return 8% per year, then the final, total amount after 30 years will be around P2.8 million.

Not bad, right? Perhaps, but if for example we assume a 4% safe withdrawal rate to determine the amount of money she can liquidate in her investments without bankrupting her portfolio, we arrive at this value:

P2.8 million x 4% = P112,000 / year = P9,300 per month

That is a far cry from the P25,000 she is earning at the present. Do you think she will live comfortably on that amount when she retires?

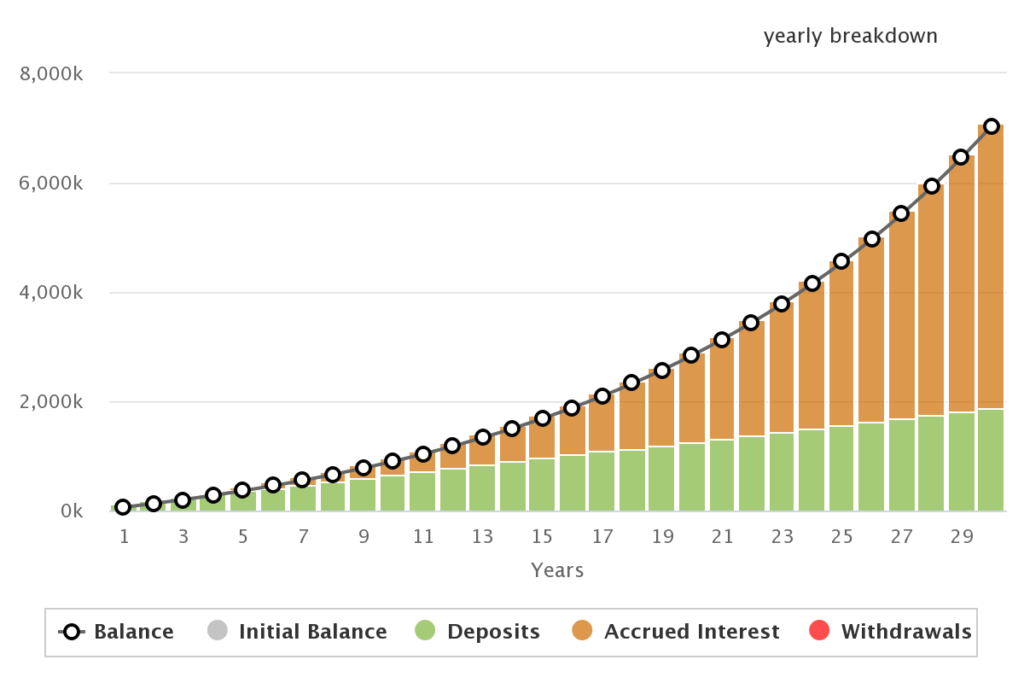

Now let’s say that through her skills and hard work, she doubled her salary from P25,000 to P50,000. Given that she still saves 20% of her income, she can now save P10,000 per month, and allot at least P5,000 to her retirement fund.

How will her investments look like after 30 years with this doubling of her income?

At the end of 30 years, her retirement fund will reach up to P7 million! Calculating her new maximum monthly withdrawal amount, assuming the same 4% safe withdrawal rate:

P7 million x 4% = P280,000 / year = P23,300 per month

This is now a more reasonable amount than the P9,300 per month that we calculated on the previous scenario.

But wait, there’s more!

One big assumption that we made in this example is that her salary stays the same throughout these 30 years. What is more likely to happen though is that Lauren’s salary will grow higher as she gains more tenure and experience in her industry. And as the examples also show, this increase in income results in an increase of scale. Her lifestyle, her timeline, and her returns will improve as a result.

Is your current situation similar to Lauren’s? Are you a diligent saver but still feel like you are not moving enough towards your goals? Then ask yourself these questions:

- Are you growing in your career? Have your skills improved these past few years or have they stayed the same?

- Do you keep your eyes open on the trends that are happening in your industry?

- Even if you are happy where you are working, are you interviewing for other opportunities so you have a good grasp of your current market value?

If you are not focusing on your career, then it is like leaving money on the table. Are you doing enough to harness this powerful asset that you already have?

Photo by Pixabay

3 thoughts on “Your most powerful investment”